UTS Corporate Finance Theory and Practice 25557

Tutorial 3, Week 4

Homework questions.

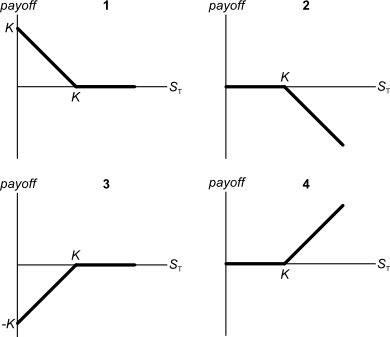

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

Some rules to help remember the way the graphs look:

- Long calls (graph 4) and long puts (graph 1) have a zero or positive payoff at maturity, so their graphs are always above the x-axis (the axis representing the underlying asset's spot price at maturity, ##S_T##). The short option graphs are the symmetric opposite, the graphs are reflected in the x-axis. The payoff is always zero or negative. This makes sense since options, like all derivatives, are a zero sum game: one trader's win is her counterparty's loss.

- The long call graph has a positive payoff if the underlying asset price goes up. It has a positive slope. The long put graph has a positive payoff if the underlying asset price goes down. It has a negative slope.

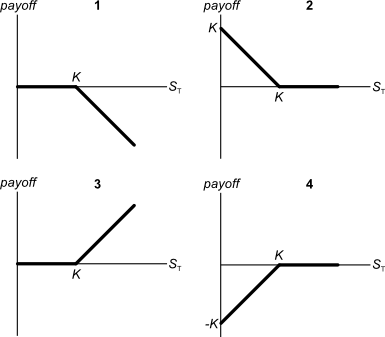

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered

Some rules to help remember the way the graphs look:

- Long calls (graph 3) and long puts (graph 2) have a zero or positive payoff at maturity, so their graphs are always above the x-axis (the axis representing the share price at maturity, ##S_T##). The short option graphs are the symmetric opposite, the graphs are reflected in the x-axis. The payoff is always zero or negative. This makes sense since options, like all derivatives, are a zero sum game: one trader's win is her counterparty's loss.

- The long call graph has a positive payoff if the underlying share price goes up. It has a positive slope. The long put graph has a positive payoff if the underlying share price goes down. It has a negative slope.

One of the reasons why firms may not begin projects with relatively small positive net present values (NPV's) is because they wish to maximise the value of their:

Firms often wait until more information is known which reveals if the project will have a higher or lower NPV. Only when the project has a high NPV is it worthwhile starting the project.

The real option value of deciding when to start a project is analogous to the decision of when to exercise a long-maturity American call option. When American call options are a little in the money, it's often best not to exercise but to wait for longer until the option is even more in the money. This is because options which are close to being at the money have little to lose and everything to gain, while heavily in the money options have lots to lose and everything to gain.

A moped is a bicycle with pedals and a little motor that can be switched on to assist the rider. Mopeds are useful for quick transport using the motor, and for physical exercise when using the pedals unassisted. This offers the rider:

This is a production or switching option because when the rider is exhausted from pedaling he can switch to using the motor, and when he wants exercise he can switch back to pedaling.

You're thinking of starting a new cafe business, but you're not sure if it will be profitable.

You have to decide what type of cups, mugs and glasses you wish to buy. You can pay to have your cafe's name printed on them, or just buy the plain un-marked ones. For marketing reasons it's better to have the cafe name printed. But the plain un-marked cups, mugs and glasses maximise your:

If the business fails then you can sell the plain cups to another cafe, thereby maximising your abandonment option.

Some financially minded people insist on a prenuptial agreement before committing to marry their partner. This agreement states how the couple's assets should be divided in case they divorce. Prenuptial agreements are designed to give the richer partner more of the couples' assets if they divorce, thus maximising the richer partner's:

Prenuptial agreements maximise the value of the richer partner's abandonment option.

An expansion option is best modeled as a call option since you only expand when the present value of business's cash flows are estimated to be worth more than the cost of investing in the business.

This is analogous to how a call option is only exercised if the underlying asset is worth more than the strike price and therefore it's 'in-the-money'.

An abandonment option is best modeled as a put option since you only abandon when the present value of cash flows from the business' operations are worth less than the payoff from abandoning.

This is analogous to how a put option is only exercised if the underlying asset is worth less than the strike price and therefore it's 'in-the-money'.

A timing option is best modeled as an American option because American options can be exercised at any time before maturity, unlike European options which can only be exercised at maturity.

The timing option value is maximised by submitting the assignment as late as possible since this allows more flexibility. The assignment can be improved at any time up to the point of submission.

The cheapest mobile phones available tend to be those that are 'locked' into a cell phone operator's network. Locked phones can not be used with other cell phone operators' networks.

Locked mobile phones are cheaper than unlocked phones because the locked-in network operator helps create a monopoly by:

Customers' option to switch network operators is destroyed when they buy a locked mobile phone. This allows the network operator to charge higher phone call prices and the consumer is faced with the decision of paying these higher charges or buying a whole new phone and switching networks which is usually more expensive. The locked mobile phone may even be sold at or below cost since it's subsidised by the higher network usage charges.

Your firm's research scientists can begin an exciting new project at a cost of $10m now, after which there’s a:

- 70% chance that cash flows will be $1m per year forever, starting in 5 years (t=5). This is the A state of the world.

- 20% chance that cash flows will be $3m per year forever, starting in 5 years (t=5). This is the B state of the world.

- 10% chance of a major break through in which case the cash flows will be $20m per year forever starting in 5 years (t=5), or instead, the project can be expanded by investing another $10m (at t=5) which is expected to give cash flows of $60m per year forever, starting at year 9 (t=9). Note that the perpetual cash flows are either the $20m from year 4 onwards, or the $60m from year 9 onwards after the additional $10m year 5 investment, but not both. This is the C state of the world.

The firm's cost of capital is 10% pa.

What's the present value (at t=0) of the option to expand in year 5?

The value of a real option is the value of the project with the option less the value of the project without the option. First find the value of the project without the option:

###\begin{aligned} V_\text{0, project} &= C_0 + \frac{p_\text{A}.\dfrac{C_\text{5, A}}{r-g} + p_\text{B}.\dfrac{C_\text{5, B}}{r-g} + p_\text{C}.\dfrac{C_\text{5, C}}{r-g}}{(1+r)^4} \\ &= -10m + \frac{0.7 \times \dfrac{1m}{0.1-0} + 0.2 \times \dfrac{3m}{0.1-0} + 0.1 \times \dfrac{20m}{0.1-0} }{(1+0.1)^4} \\ &= -10m + \frac{0.7 \times 10m + 0.2 \times 30m + 0.1 \times 200m }{(1+0.1)^4} \\ &= 12.53944403m \\ \end{aligned}###If the C state of the world happens, we have to decide if we will let the option lapse or exercise our option to invest and expand. We will do whatever gives a higher value. The decision is made in year 5 but values will be calculated in year 4 for convenience.

###\begin{aligned} V_\text{4, C let option lapse} &= \dfrac{C_\text{5, C}}{r-g} \\ &= \dfrac{20m}{0.1-0} \\ &= 200m \\ \end{aligned}### ###\begin{aligned} V_\text{4, C exercise option} &= \dfrac{C_\text{5, C, invest}}{(1+r)^1} + \dfrac{ \left( \dfrac{C_\text{9, C, invest}}{r-g} \right) }{(1+r)^4} \\ &= \dfrac{-10m}{(1+0.1)^1} + \dfrac{ \left( \dfrac{60m}{0.1-0} \right) }{(1+0.1)^4} \\ &= 400.7171641m \end{aligned}###Since exercising the option to expand gives a higher value, we'll do that.

###\begin{aligned} V_\text{4, C} &= \max(V_\text{4, C let option lapse}, V_\text{4, C exercise option}) \\ &= \max(200m, 400.7171641m) \\ &= 400.7171641m \end{aligned}###Now to calculate the value of the project with the option.

###\begin{aligned} V_\text{0, project with option} &= C_0 + \frac{p_\text{A}.\dfrac{C_\text{5, A}}{r-g} + p_\text{B}.\dfrac{C_\text{5, B}}{r-g} + p_\text{C}.V_\text{4, C} }{(1+r)^4} \\ &= -10m + \frac{0.7 \times \dfrac{1m}{0.1-0} + 0.2 \times \dfrac{3m}{0.1-0} + 0.1 \times 400.7171641m }{(1+0.1)^4} \\ &= 26.24869641m \\ \end{aligned}###The option value is the difference:

###\begin{aligned} V_\text{0, option} &= V_\text{0, project with option} - V_\text{0, project} \\ &= 26.24869641m - 12.53944403m \\ &= 13.70925238m \\ \end{aligned}###An incremental analysis can also be done which will give the same option value and might be a little easier since it avoids valuing the entire firm.

###\begin{aligned} V_\text{0, option} &= p_C.\left( \dfrac{C_\text{5}}{(1+r)^5} + \dfrac{\left( \dfrac{C_\text{9, gain}}{r-g} \right)}{(1+r)^8} - \dfrac{\left( \dfrac{C_\text{5, opportunity cost}}{r-g} \right)}{(1+r)^4} \right) \\ &= 0.1 \times \left( \dfrac{-10m}{(1+0.1)^5} + \dfrac{\left( \dfrac{60m}{0.1-0} \right)}{(1+0.1)^8} - \dfrac{\left( \dfrac{20m}{0.1-0} \right)}{(1+0.1)^4} \right) \\ &= 13.70925238m \\ \end{aligned}###